Can You Still ‘Truss’ Us!?

World Monetary Authorities Are Losing Control Of Their Bond Markets

2025 is not starting well. World bond yields are rising (nearly) everywhere and they threaten to kill the ‘Everything’ bull market, despite policy rate cuts and promises of more. Hard-pressed China is the exception. Bootstrap estimates of US Treasury yields confirm a 5.5% 10-year yield target.

From their mid-2020 price peak, a zero coupon 10-year US Treasury note has lost 22% in value, but its performance easily outstrips the fast disappearing TLT ETF which has halved. The recent pattern of 10-year US treasury yields is reported in the chart below. It warns that things could even get worse. Don’t forget Britain’s ‘Liz Truss’ moment in 2022.

The culprits are expanding term premia. These have played a key role since year 2000, explaining some 80% of 10-year US Treasury yield. Despite the US Fed and other Central Banks signalling further interest rate cuts, rising term premia warn that governments are losing control of their bond markets.

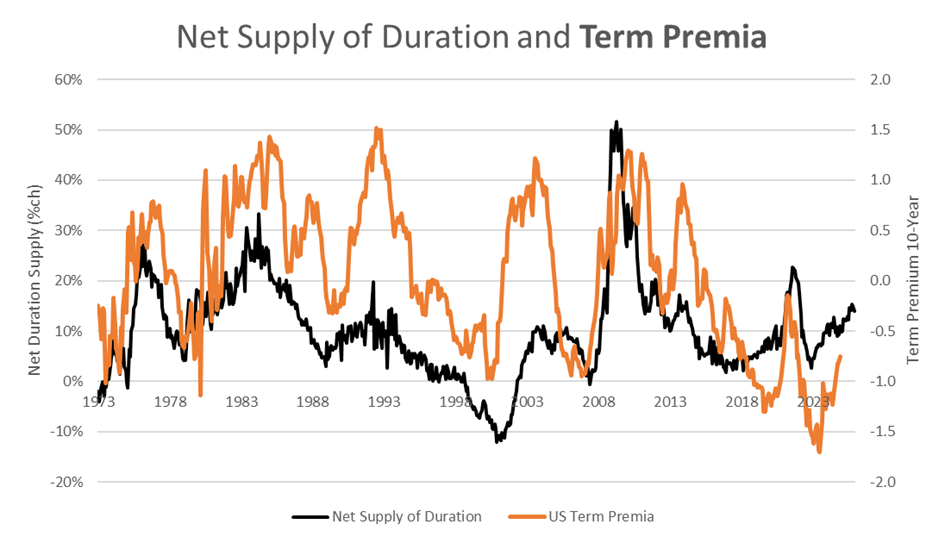

Rising US bond term premia, shown below, underpin the worrying break-out of yields on the upside, certainly since their mid-2023 lows and evidently again with new vigor from mid-2024. This reflects growing imbalances between supply and demand. Demand for ‘safe’ asset government bonds is determined partly by regulations and partly by the abundance of Global Liquidity, i.e. more liquidity means less need to hold ‘safe’ assets. New supply is measured by coupon issuance, but with longer duration securities requiring greater balance sheet capacity.

During the late-1980s so-called bond vigilantes scoured World bond markets, threatening to discipline wayward public borrowers. The specter of bond vigilantes could again shock nervous risk markets in 2025. After being dormant for decades, they infamously returned in late-2022 to threaten the UK Gilt market so severely that their actions led to new Prime Minister Liz Truss resigning after only 49 days in office, following the announcement of ‘unfunded’ tax cuts.

UK Gilt yields were forced up by over 200bp and with alacrity over barely a 3-week period. Put into context, the same hit to US yields would potentially add a whopping US$500 billion to the already bloated Federal deficit and jumping America’s annual debt costs by half again.

America’s particular problem likely hinges not on a lack of prospective Fed policy rate cuts, rather on the need, not only to fund the rapacious Federal budget deficit, but also to reverse Biden Treasury Secretary Janet Yellen’s ‘temporary’ shift towards the greater use of short-term finance. New Treasury Secretary Scott Bessent has vowed to return to using longer-dated coupons to fund government, even through this will inevitably boost coupon debt supply.

Evidence the following chart which shows how changes in the net supply of US Treasury coupon debt affects the size of term premia at the benchmark 10-year tenor. Roughly each 10% increase in the pace of net bond supply (ex bills) adds 50bp to term premia and yields. We have added in the impact of rising Fed liquidity, which tends to reduce ‘safe’ asset demand for bonds. Eye-balling the chart, it seems likely that US term premia could test parity, using our measures. (Note these are lower than the equivalent ACM estimates from the NY Fed).

The key point here is that bond term premia have been unusually depressed over recent years by the slower pace in coupon supply and the reduced demand for ‘safe’ asset bonds following sharp rises in Fed Liquidity provision. Looking ahead, we have assumed a more prosaic path for the Fed balance sheet and penciled in a return to a more ‘normal’ funding mix. Under these conditions, net debt supply is slated to quickly return to a 10-15% annual clip. Equivalently, we must expect some ‘normalization’ in term premia, recalling that, according to the textbooks, term premia are typically positive, i.e. a ‘premium’, as it says on the tin.

As a cross-check, the ‘true’ 10-year US Treasury yield can be bootstrapped from the Agency mortgage markets using similar risk-free securities. See next chart. Agencies do not suffer the same issuance distortions as conventional Treasuries, and although they differ in duration and convexity, these properties can be offset in the calculation. The gap, as reported, is once again around a full percentage point and confirms our earlier warning that 10-year Treasuries are on course to test 5.50%.

Therefore, with the GFC and COVID emergency now well behind us, World bond markets need to adjust to the new underlying trends. These trends are dominated by three forces: (1) ageing demographics; (2) defense/ Geo-politics and (3) limited funding capacity.

In short, Western governments will struggle to fulfill social welfare commitments, particularly those, like Britain, that already run huge current account deficits. The likely alternative is the monetization of public deficits, i.e. ‘printing money’. But with the West, and large parts of the East, collectively in the same difficult position, this monetization threatens to be widespread. This is what the skidding bond markets may be concluding. Therefore, we should be watching for further general devaluations of paper money versus gold. This would be especially noteworthy against a rising yield backdrop.

America, at least, has the World’s reserve currency and has capacity to offload her debt on to countries, like the Eurozone, Japan and the Middle East, dependent on her defense umbrella. The US fiscal plight still matters, but against this background it looks more manageable for the dollar. Holding Sterling, Euros, Yen and Yuan, and certainly most Emerging Market currencies, and their respective bond markets is far more troubling.

Financial crises tend to come in two stripes: (1) crises of monetary deflation and (2) crises of monetary inflation. Think of the USD gold price as a measure ie respectively down and up. Monetary deflations can be corrected by offsetting monetary inflations. That was the reason for the 1934 Gold Act. Think also of the gold price since 2000. Another burst of monetary inflation is due!

Hello Michael, basic question that I know is unrelated to this post specifically..

If Global Liquidity continues to track lower into this year, this insinuates BTC could struggle in the intermediate/short term until we see sufficient stimulus (enough to spill into risk assets) from central banks?

In my mind, this stimulus seems likely as we approach the debt wall into mid-year and beyond. After this stimulus, the ‘’Quantitative Support’’ could kick off another raging bull due to how reflexive BTC is with regard to Global Liquidity?

Appreciate your thoughts if you have any! Thank you for your work. I am still studying and I value your content very much.