Why Is Gold Outperforming Bitcoin?

Understanding Relative Monetary Shifts (Part 2)

We recently suggested that there is no ‘Great Debasement’ trade. Rather China is the main driver of the soaring gold (and silver) price. (https://t.co/9w44JOqbO3) In this report we dig deeper and examine the relative performance of gold versus Bitcoin. Both are monetary inflation hedges, but Bitcoin is lagging. We argue the reason is that not all liquidity is equal—where it originates and how it circulates (financial vs real economy, China vs US) has critical asset-specific effects. We conclude that the gold/ Bitcoin divergence is fundamental and cyclical, not a failure of one asset over the other. This conclusion is a perspective worth noting in portfolio allocation.

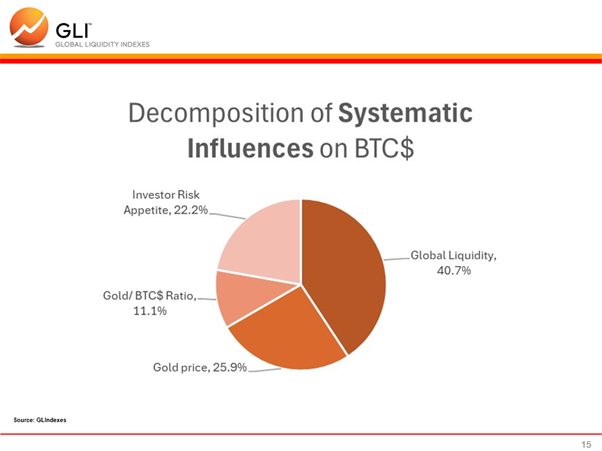

From an analysis of weekly data using a VAR model, we published this pie chart in mid-2025 detailing the systematic influences on Bitcoin. It shows three main conduits plus a fourth feedback term. Global Liquidity (41%); investors’ risk appetite (22%) and gold (26%) all positively influence the Bitcoin price. However, gold, itself, has a complex two-way interaction that is captured through the gold/ BTC$ term (11%). In the long-term term, gold and Bitcoin are positively correlated. However, in the short-term the relationship is strongly negative. In other words, gold and Bitcoin trend together, but they cycle apart.

This seems to describe exactly what is going on today: gold it breaking all-time highs, while Bitcoin languishes. Let’s dig deeper.