What Are Credit Markets And Global Liquidity Really Telling Us?

Weak Economy And Deteriorating Corporate Credits Spell Danger For Future Global Liquidity

What will the rest of 2025 bring? This reports builds on some recent themes about the fragility of finance, future debt roll-overs and the slow and inactive Federal Reserve. It examines, in more detail, the structure of the World financial system and the central roles played by repos (a type of security-backed loan) and collateral.

As investors, we remain uneasy, especially given upcoming credit risks. Central to our view is the on-going reversal of the hidden stimulus engaged by the US Fed and Treasury in early-2024 (or what we have called ‘Not-QE, QE’ and ‘Not-YCC, YCC’). This was and is a big, big deal. We explore the implications?

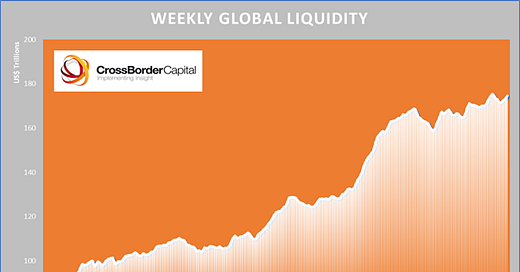

The latest weekly track of Global Liquidity is shown in the chart below. Admittedly, this aggregate pool of cash continues to inch higher, but it is also clear that its momentum has slowed markedly. The risk of a reversal in Global Liquidity is high, especially if the US Federal Reserve also refuses to add more liquidity to thirsty US markets.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.