US Bond Term Premia

A Note on Technical Clarification

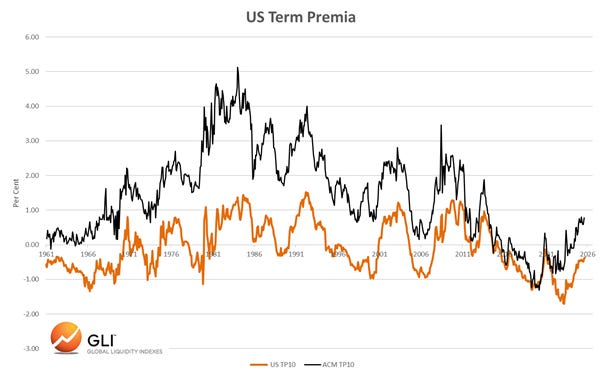

A number of readers have, not surprisingly, questioned our warmer feeling towards bonds (See https://t.co/8pv6Rd2ujI) and asked specifically why our estimates of US bond term premia are so different from the widely-quoted ACM estimates published by the New York Fed? At the risk of being a tad wonkish and discussed bond math, here goes! Evidence the chart below:

While the turning points of the two sets of estimates always appear to coincide, the levels are different and the gap at times exceeds 400bp. However, the clue to the difference lies in the fact that our term premia data (orange line) is statistically stationary (ie constant mean and variance) whereas the ACM data (black) trends for long periods and plainly is not stationary. To serve as term premia, the data should be stationary and average a mean of near zero, according to textbook theory.