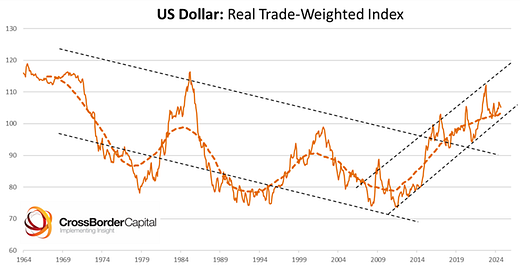

The US dollar has surged in the wake of Trump’s Election victory. Further strength is dangerous for investors in risk assets, but further gains could be inevitable. A strong US dollar raises debt costs for foreign borrowers and significantly reduces the flow of Global Liquidity, both directly, as credit terms deteriorate, and indirectly, as foreign policy makers tighten money to support their currencies. We estimate that each 10% rise in the DXY trade-weighted dollar index reduces our Global Liquidity Index by around five index points. At current levels of 49.9 (‘normal’ range 0-100) this is equivalent to a 10% fall. Given the high beta of risk assets to changes in Global Liquidity, e.g. S&P500 at 1.35x, this is important.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.