Is Trump 2.0 Planning A ‘New’ Gold Exchange Standard?

Ex Nihilo, But Huge Implications For Investors

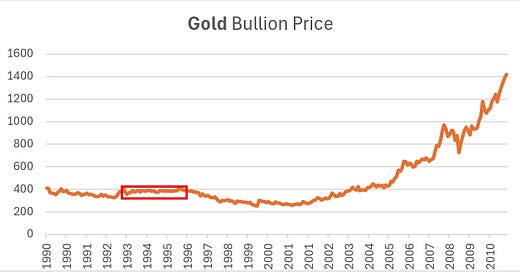

Could the next ‘Big Thing’ involve some return to a gold-backed monetary system? If so expect a shakedown in cryptocurrencies and other monetary inflation hedges. Gold, after an initial surge, could settle at a higher level. And, the US dollar is likely consolidate its position as the paper currency of choice. However, as we argue below, the critical question is what happens next: will the Fed be mandated to target a fixed gold price or a steady gold trend? This matters!

New US Treasury Secretary Scott Bessent mystically hinted that within the next 12 months the Administration will announce ways to “...monetise the assets side of the US balance sheet for the American people”. Many pundits have concluded that this statement specifically refers to US gold holdings, rather than to prospective sales of other assets. Consequently, the price of gold has surged. They claim that gold is likely to be revalued higher (but kept non-convertible), leading to a one-off windfall gain for the US Treasury and a large increase in the size of the Treasury General Account (TGA) held on the Fed’s balance sheet. There is, after-all, a precedent, since FDR revalued gold from $20.67/ oz to $35/ oz in 1933.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.