Has The US Treasury Lost Control of the Bond Market?

Understanding Bond Term Premia (Spoiler alert: 'yes')

Long-term Treasury yields continue to edge higher. Investors’ need to better understand why? Bond math is often wonkish and for many tedious! Nonetheless, the reason is largely explained by rising term premia, a key underlying component of bond returns. Since 2010, 95% of bond yield movements stem from premia shifts (vs 47% historically). Through their direct impact on long-term rates, term premia drive future policy rates, not vice-versa. Negative underlying term premia, reflecting supply/demand imbalances, and the Treasury’s loss of pricing power create a potent setup for yield surges and higher rates. Investors should prepare for a test of 5-6% in 10-year US Treasury yields unless economic growth falters. Given the huge importance of collateral in the future generation of Global Liquidity, both rising yields (falling collateral pool) and greater bond volatility (lower collateral multiplier) matter hugely.

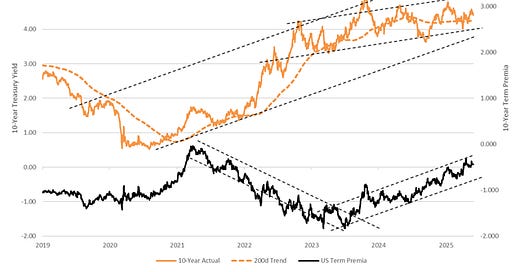

The chart below shows US 10-year Treasury yields and our estimates of daily term, premia. Much of the recent yield increase is done to higher term premia. More worryingly, the trend in term premia looks both upward and robust.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.