Happy ‘Fed Day’

Could Fed Quantitative Tightening (QT) End Very Soon?

A big week lies ahead for financial markets and it not just because of the upcoming FOMC announcement due November 7th. This ‘Fed Day’ will be important: First, because it comes after Treasuries puked following the 50bp cut in policy rates in the previous FOMC. Second, because the Fed surely needs to say something about its future balance sheet structure and, specifically, whether it could formally end-QT. Hold on tight!

The following chart shows how Treasury 10-year yields have moved up smartly since September, but more worryingly the trend in term premia (the risk premia for holding duration) has been plainly trending higher since last year. It questions whether US policy makers are losing their grip?

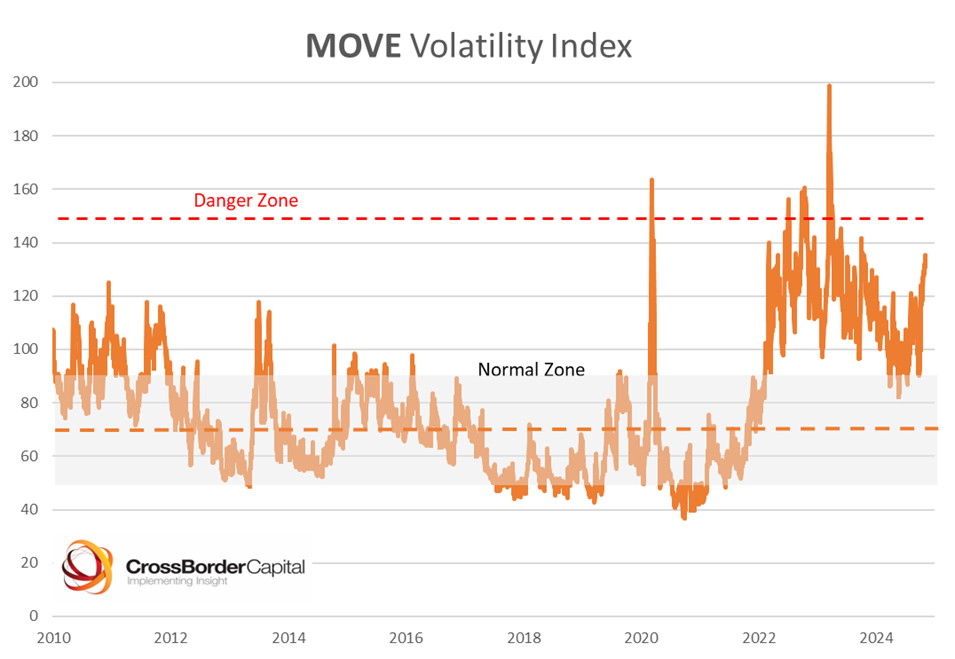

The MOVE index of implied volatility across the term structure seems to confirm this. The index shot higher through October, admittedly largely for technical reasons because the Election got caught in its 1-month rolling window. However, the raw fact is that implied volatility has jumped towards its ‘danger zone’ threshold and this matters hugely for funding markets because it will mean bigger ‘haircuts’ applied to collateral. This will destroy vital liquidity. In fact, the repo markets already evidence growing tensions as the following chart confirms. Spreads between SOFR and Fed funds rates are more often trading above their normal range.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.