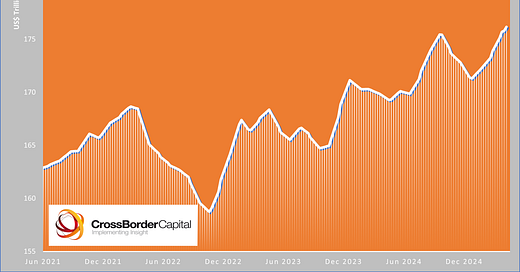

Global liquidity continues to creep higher according to latest weekly measures derived from major Central Banks’ balance sheets. It edged up to US$176.2tr last week – a new record high. Year-to-date it has expanded by over US$5tr. Improving Central Bank liquidity (thanks to the Fed and PBoC) and a sliding US dollar have helped. While the latter continues, Fed and PBoC liquidity growth has slowed. We will be monitoring closely. That said, liquidity impacts risk asset markets and cryptocurrencies with a delay of around 3 months, so Q2 may be saved by the Q1 liquidity upturn. Our risk exposure indexes show that investors are still “risk off” but tentatively returning to risk assets following the early April rout.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.