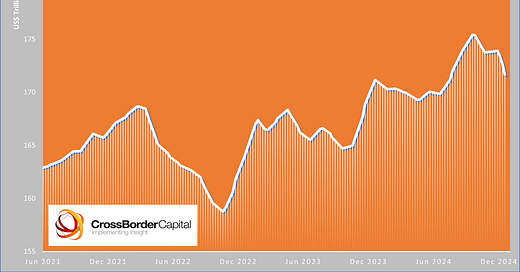

Global liquidity conditions in 2024 can be best summed up as a glass half full. Global liquidity rose strongly from Q3, but dipped back somewhat in Q4. As we approach the year-end, liquidity is just 0.3% higher on the year. This lacklustre performance is due to the strong US dollar and weak Central Bank liquidity growth. We stand by our view that liquidity will expand a tad further during 2025 before peaking in Q4. Risk asset markets perform best when liquidity is growing strongly so it comes as no surprise that they have faltered in recent weeks. There may be some more upside as the final upswing of the current liquidity cycle plays out but the best of times are likely already behind us.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.