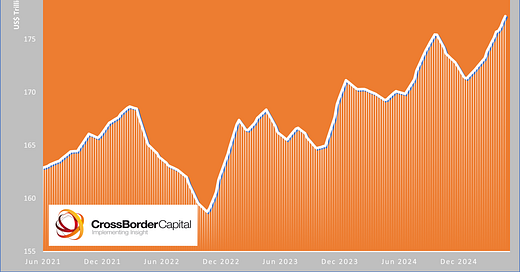

Global liquidity is rising steadily and has reached a new all-time high of US$177.2tr, according to measures derived from the weekly balance sheets of the major Central Banks and collateral values. We had expected the current liquidity cycle to peak around Q4 this year. However, the rapidly deteriorating global economy which will likely spur Central Banks to ease has caused us to reconsider. All in all, we now expect the cycle to peak in mid-2026. For the moment risk asset markets and liquidity-sensitive cryptocurrencies are benefitting from the Q1 liquidity upturn. Q2 has started well with liquidity rising through April but the Fed’s inertia worries us…

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.