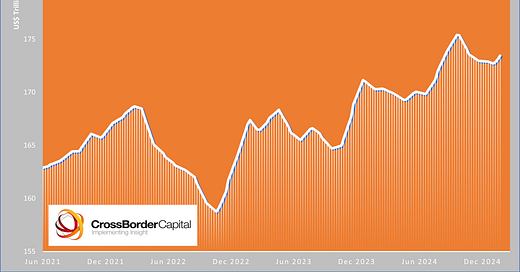

Global liquidity levels have stabilized following the Q4 dip. Four factors are underpinning them: (1) Improving Central Bank liquidity, due to the PBoC and ECB. Fed liquidity remains a cause for concern. (2) Collateral values (bonds) which are picking up, in part helped by (3) the loss of momentum in the US dollar. And finally (4), bond market volatility which has retreated from its November peak. Liquidity leads risk asset markets, gold and cryptocurrencies. They recently lost momentum in response to the liquidity slowdown that started in October 2024. Gold and risk assets have recovered in the last week, but they may have got ahead of themselves? More liquidity is needed.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.