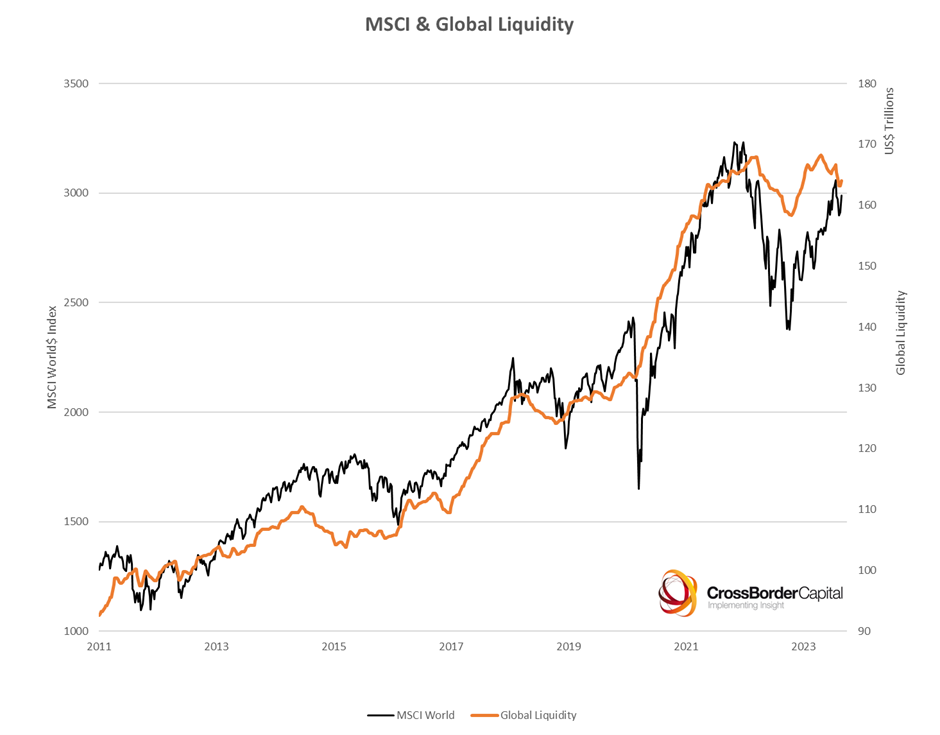

Small Uptick, But Short-Term Downtrend Still Evident

Latest weekly data show a small uptick in Global Liquidity to US$164.0 trillion or still 3½% below its earlier peak reading. This is likely to constrain World risk assets as the chart below on the MSCI World equity index suggests. However, we are not yet seeing conditions that make us reverse our bullish medium-term views. This is likely a correction caused by: (1) the negative impact on collateral of rising bond yields, and (2) the erratic behaviour of Chinese Central Bank liquidity as the Chinese Yuan tries to avoid a tail-spin lower.

Source: CrossBorder Capital, US Federal Reserve, People’s Bank of China, ECB, Bank of Japan, Bank of England, MSCI

In the medium term, we expect the Chinese policy makers to accept a radically weaker Yuan. This will allow renewed easing by the PBoC (People’s Bank). However, Central Banks do not like accelerating currency falls, and they will try to offset these in the short-term by tightening policy. The chart below highlights the latest policy moves. Alongside and possibly connected, we are seeing upward pressure on global bond yields, led by the US Treasury market. China may be selling US dollars and, hence, Treasuries to help protect the Yuan.

Source: CrossBorder Capital, People’s Bank of China

US Treasury yields are not rising because of any increase in inflation expectations, despite the latest jump in oil prices. Rather, higher yields are explicitly the result of rising real yields, and, specifically, a steady increase in depressed bond term premia.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.