Global Liquidity Slowly Rebuilding

Analysis of end-June global liquidity conditions, based on our broadest liquidity measures

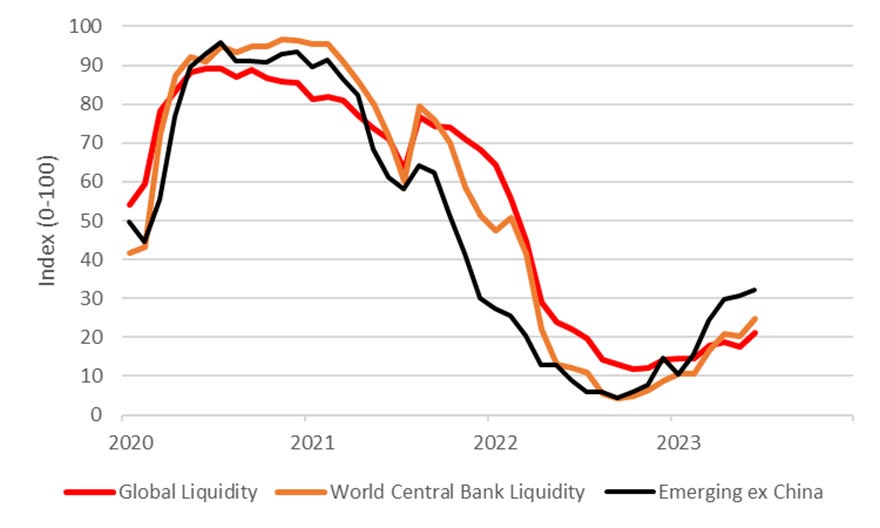

Latest Global Liquidity data for end-June 2023 (shown in the chart below) again confirm last year’s October cycle low and evidence a slow rebuild, but the GLI™ index at 21.3 (‘normal’ range 0-100) remains depressed.

Global Liquidity and World and EM ex China Central Bank Liquidity, 2020-23 (End-month observations, broad definition, Indexes 0-100)

Sources: CrossBorder Capital, US Federal Reserve, People’s Bank of China, ECB, Bank of Japan, Bank of England, IMF

Within the total there are several strong features:

· Cross-border flows to Emerging Markets (ex China) continue to be buoyant (index 61.8)

· EM Central Banks are consequently easing quickly (index 73.3)

· Robust World private sector liquidity (index 33.5) is inconsistent with an upcoming major recession.

Among the majors, Japanese Liquidity is plainly rising (index 32.6) and has doubled since December. Chinese Central Bank Liquidity also zoomed higher in June to a sky-high index of 85.5, reflecting her renewed intent to ease.

World markets in the first half of 2023 have again defied the popular narratives. Cyclical and tech stocks have outperformed, consistent with an upcoming rebound in World business, and speculative credits have outperformed conventionals, consistent with the Rebound phase of the liquidity cycle. What’s more, as we argue below, the Japanese Yen may have been politically ‘weaponized’.

We continue to believe that the Global Liquidity cycle bottomed last October, largely for financial stability reasons, but also because the significant slowdown in World business activity will release working capital back into financial markets. Yet, we do not expect a major recession and rather look forward to evidence of a coming turn in the World business cycle in the next few months.

Yield curves are currently distorted by hugely negative bond term premia. They likely tell us more about financial fragility and underline why Central Banks need to quickly restart and maintain QE policies.

Even though we remain cautious of bonds and cannot see rapid rate cuts, we are positive towards equities because inflation is (for now) falling fast. Low inflation matters greatly for equities, and we suspect that behind the market rally is the fact that inflation is falling faster than the economy is slowing. On top, we predict that more liquidity is coming and probably from Asia, but a precondition for this may be a softer US dollar. That could be near.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.