Global Liquidity Conditions Under Pressure From Volatile Collateral Values

Recent Trends In The Data

Global liquidity conditions under pressure from volatile collateral values and generally restrained Central Banks. Latest data show Fed liquidity edging lower. The exception is the People’s Bank of China, which is increasing liquidity supply. Our risk appetite indicators show that, so far, global risk markets are holding up, but bonds – the bedrock of collateral – are volatile and are undermining liquidity conditions. We are in choppy waters!

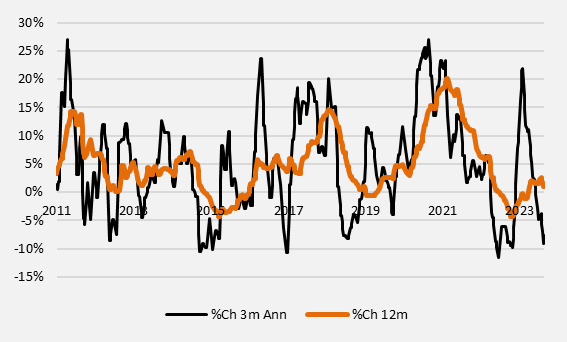

Our weekly Global Liquidity monitor shows that liquidity conditions are under pressure. This measure is derived from the shadow monetary base (SMB) (see description at end of article). Figure 1 shows the 3m annualised and year-on-year growth rates of this weekly Global Liquidity indicator. It is currently shrinking by around 8% on a 3m annualised basis. The SMB itself is showing similar weakness (6.6% 3m ann.; see Figure 2).