Global Central Bank Liquidity Update : Better But Simply Not Enough

Latest weekly Central Bank data show a marked improvement but liquidity growth is still weak. PBoC and ECB are behind the upturn

Latest weekly data from the major Central Banks show liquidity conditions at last stabilizing, after 3-4 months of persistent weakness. The People’s Bank of China (PBoC) and the ECB are behind the improvement. The former is a genuine liquidity boost, the latter is due to a base effect. Encouragingly, US Federal Reserve (Fed) liquidity levels are also stabilising. Countering this, the Bank of Japan (BoJ) and the Bank of England (BoE) are withdrawing liquidity from the system and remain a drag on overall liquidity growth.

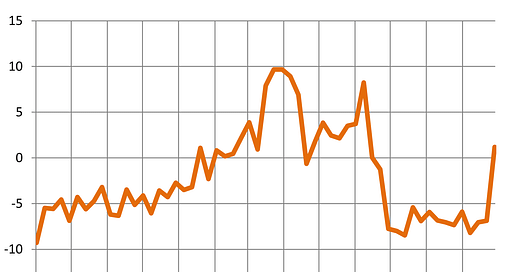

The chart below shows the 3-month annualised growth/contraction rate of major Central Banks’ aggregate liquidity. The latest reading of +1.2% is a marked improvement on the -7.0% average recorded since June.

Source: CrossBorder Capital, US Federal Reserve, People’s Bank of China, ECB, Bank of Japan, Bank of England

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.