Future Prospects For Global Liquidity

Does The Surge in Liquidity-Sensitive Assets Mean Anything?

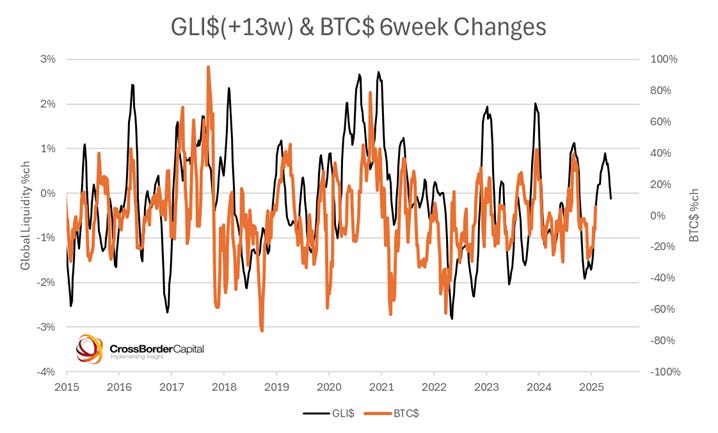

The sharp recent rallies in gold and Bitcoin prices, two highly liquidity-sensitive assets, have spurred hopes of rising Global Liquidity. There are mixed reasons why Global Liquidity is currently expanding, some likely short-lived (related to US debt ceiling) and other more structural (Chinese monetary stimulus). We cannot argue with latest positive data. However, we are more circumspect about future prospects.

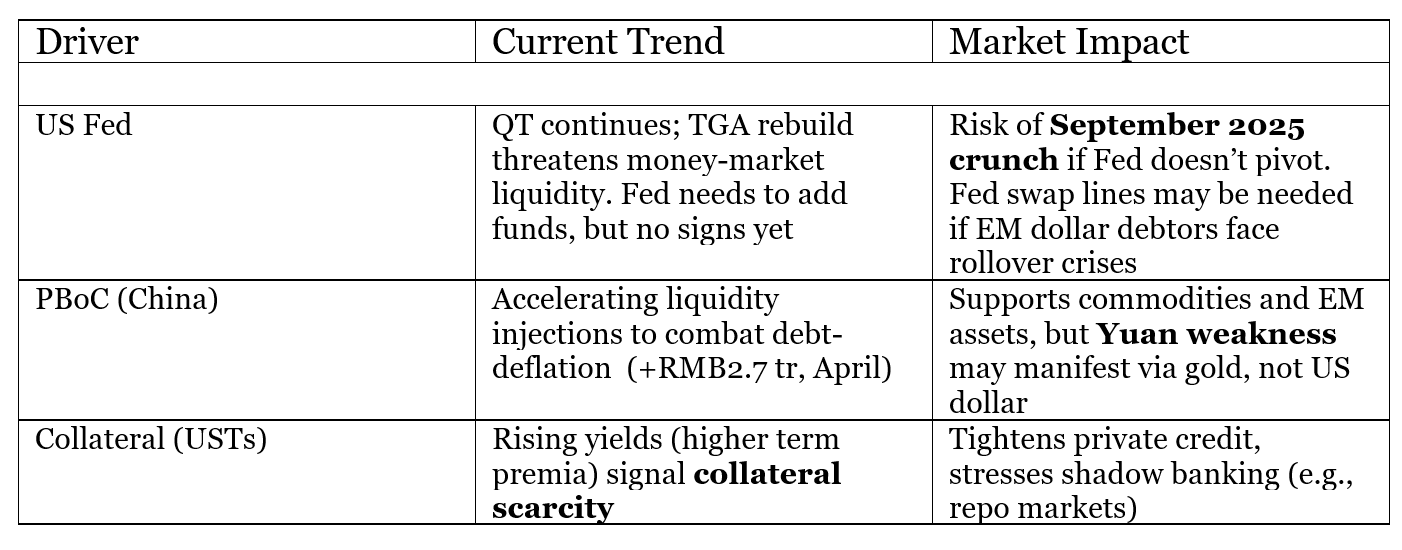

Global Liquidity is approaching a cyclical peak, in our view, and projected to reach an index level near-70 by mid-2026 (index range 0-100). Percentage growth will be modest compared to the 2020/21 surge, but the cycle is likely to take on a double-hump pattern as the initial (late-2025) dip is likely offset by renewed policy easing. China's PBoC has already shifted to sustained easing (helping to support EM assets and commodity prices), but the US Fed's stubbornness, evidenced by continued QT (quantitative tightening) and impending Treasury General Account (TGA) rebuild, risks a liquidity crunch by September 2025 that could further strain repo markets.

Meanwhile, rising US Treasury yields and heightened bond volatility signal collateral scarcity and tightening private credit conditions. The gathering World growth slowdown may eventually spur Central Bank policy easing, but oil at over $80/bbl. and a still-robust US dollar backdrop will likely limit the upside in Global Liquidity.

Investors should continue to position defensively in short-duration Treasuries and precious metals, near-term, taking more caution with corporate credits because of recession risks. The looming 2025/28 debt refinancing wall is the next big test, particularly for commercial real estate and the high yield markets. While Global Liquidity tailwinds persist into 2026, the US Fed faces an increasingly difficult choice between inflation control and financial stability as potential collateral shortages and dollar funding gaps emerge. Markets remain dependent on Central Bank liquidity support, but the financial plumbing is starting to show strains.

Prospects For Global Liquidity

The drivers of Global Liquidity can be analyzed from two-dimensions: First, the direct contributors, namely Central Banks, such as the US Fed and China’s PBoC, and private high street banks and shadow bank lending through collateral markets. And, second, indirectly by considering the factors that determine these underlying policy decisions, such as the tempo of the World business cycle, oil prices, the level of the US dollar and collateral volatility. This note explores both dimensions.

Upfront, we conclude that the Global Liquidity cycle may have slightly further to run, but we are already close to a peak and further gains anyway assume a much slower World economic outlook.

The chart below shows future projections of Global Liquidity based on systematic modelling. Recent Global Liquidity data is volatile because China has been forced to deliberately follow a ‘stop-go’ policy in order to protect the fragile Yuan. This policy has likely ended, as we argue below, helped by the slump in the US dollar. The global cycle is slated to peak at an index of near-70 around mid-2026, compared to its latest reading of 47.9 (range 0-100). This is appreciably below the 2020/21 peak, but that was the result of an extreme and widely co-ordinated policy response to the COVID emergency.

Note the recent volatility in our Global Liquidity Index (GLI). This is likely temporary and entirely down to China (see above). China’s PBoC fuelled money markets with a whopping RMB 2.7 trillion (US$380 bn) in April.

Our original projection from 2022 of a late-2025 peak in the Global Liquidity Cycle still holds, but the data show that the decline is arrested by a likely policy easing in response to a skidding World economy. This probably extends the cycle into 2026.

Direct Liquidity Drivers

Summary Table: Direct Liquidity Drivers

Indirect Liquidity Drivers

Our analysis suggests that Global Liquidity is systematically driven by four key factors: (1) the pace of the World business cycle; (2) the level of oil prices; (3) the US dollar and (4) bond market volatility. These factors act with a lag averaging some 6-15 months. Hence, a weak World economy will not only channel surplus funds back into financial markets, but should also encourage Central Banks to ease. A slightly weaker US dollar will add some support, but more than offsetting this, heightened bond market volatility (see MOVE index) will impair collateral and reduce Global Liquidity.

Conclusion: More Liquidity Coming, But Enough?

It is always dangerous to forecast future Global Liquidity, not least when the major player, the US Federal Reserve, is stubbornly refusing to expand its balance sheet. However, the rapidly deteriorating path of the World economy is likely to spur renewed policy ease among World Central Banks. Already, the People’s Bank (PBoC) has opened Chinese liquidity taps.

This backdrop persuades us the long-slated late-2025 peak in Global Liquidity will be quickly offset and pushed back into mid-2026. Politically, this may prove awkward timing for the new US Administration because Global Liquidity will be in decline ahead of the Mid-Terms. This second peak is still likely to fall below the previous 2020/21 cycle peak that followed COVID. On top, investors’ risk appetite is grinding lower under pressure from skidding economies.

Hence, we are reluctant to move back into risk markets yet, even though some rebound may be deserved. Nonetheless, the likely inevitable policy response of ‘more liquidity’ is a great future omen. It establishes the upward path of persistent monetary inflation that ultimately underpins hedges such as gold, quality equities, prime residential real estate and Bitcoin.

Thanks for the article, and also I like the new format of including summary TLDR and tables, from the last couple of posts. How do you think the potential QE, urged on by a newly appointed Fed chairman, next year affect your thinking on liquidity peak? Seems like that could drag out the cycle longer into a bigger crash of some kind eventually, while we may still get volatility or recession driven crashes before then?

Hi Michael, I recently subscribed and am a big fan of your research. Just ordered Capital Wars! Thanks vm for the views.

I would be interested in your view regarding deregulation in the banking sector, potentially unlocking USD's on balance sheets which have been held tight since post GFC banking regulation. Could it make of an interesting dose of liquidity at a time the markets needs it most, in the second half of this year?

Many thanks again for the research!