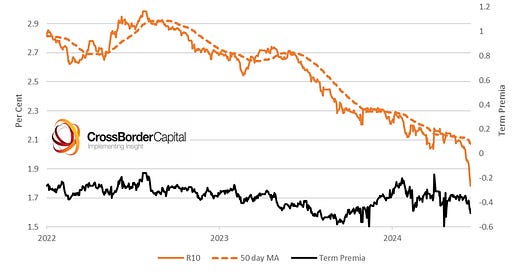

Wall Street is the most important stock market in the World, but Chinese treasuries are (probably) the most important bond market, given China’s huge economic footprint and dominance of global manufacturing. That Chinese bond yields are plunging (prices soaring) should be flashing red lights on every trading screen around the globe. 10-year Chinese government bonds ended last week (12/13/24) yielding a measly 1.78%: a 40bp drop in barely three weeks, as the chart below shows. The fact that this latest fall is largely driven from collapsing term premia, rather than expectations of policy rate cuts, is more disturbing since it warns of Japanification and further debt-deflation.

Keep reading with a 7-day free trial

Subscribe to Capital Wars to keep reading this post and get 7 days of free access to the full post archives.